What is first party data and what has GDPR changed?

What is first party data?

The data used by brands falls into three categories: Third, Second and First Party Data.

Third Party Data represents the largest volume: it is the data available in third party platforms such as Facebook or Google.

Second Party Data is that which can be exchanged with partners.

First party data refers to data collected directly by a company. In the marketing context, this is usually customer or prospect data. This data is stored by the company, which is responsible for it. The company does not own the data, but it collects it and can use it with the informed consent of the individual.

In marketing, we mainly distinguish between two categories of first party data:

- behavioral data that is tracked: browsing on websites and applications (recorded using cookies) or reactions to email or SMS campaigns, for example.

- CRM data, which is associated with an individual in the customer database: for example, purchase data, responses to surveys, data collected by customer service, etc.

First party data is generally better controlled because it is collected and stored directly. This quality makes first party data a central element of the digital strategy for 90% of Marketing professionals, according to the article ThinkwithGoogle: Responsible Marketing and Proprietary Data (June 2020).

A stricter collection context with the GDPR

The entry into force of the GDPR on May 25, 2018 has brought order to the management of first party data, and increased the level of requirements vis-à-vis brands. This can be summed up in 4 points:

- Protection of personal data

- Collection of data justified by a purpose

- Limited data retention

- Increased corporate responsibility

If at first glance, the GDPR initially seems to be a brake on the marketing strategy of brands, this is not the case: almost 4 years after the entry into force, the virtuous effects of this regulation are obvious. It has created the foundations for a better relationship of trust between brands that play the game (and show it) and customers. And this trust builds loyalty, as 95% of customers say they are more likely to be loyal to a company they trust (Salesforce Study | Trends in Customer Trust. The future of personalization, data, and privacy in the Fourth Industrial Revolution).

On the other hand, this change in the rules of data marketing leads to a clear challenge for brands: having a clear promise of value for the consumer, in exchange for their data.

Building a customer database is a key issue for brands

The challenge of first party data is primarily marketing.

This marketing challenge is based on three points:

1. Know your market better:

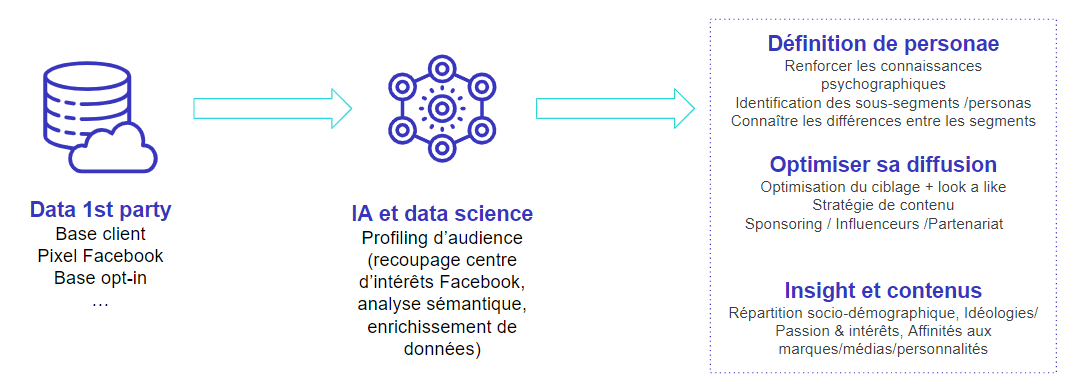

It is first and foremost an issue of knowing consumers, of their core target. By analyzing first party data, or even deepening it with profiling solutions using Facebook data or socio-demographic data (as with the Family Square solution), it is possible to better understand its consumers and their habits. By interacting with these contacts, it is possible to detect trends, feedback, consumer expectations, to adjust the marketing strategy.

2. Target and personalize communication

By having first-party data, the brand can communicate directly with its core target (CRM) and do so in a segmented way: by product category, by consumer profile, etc. It also makes it possible to project this core target by targeting “look alike”.

3. Optimize marketing investments

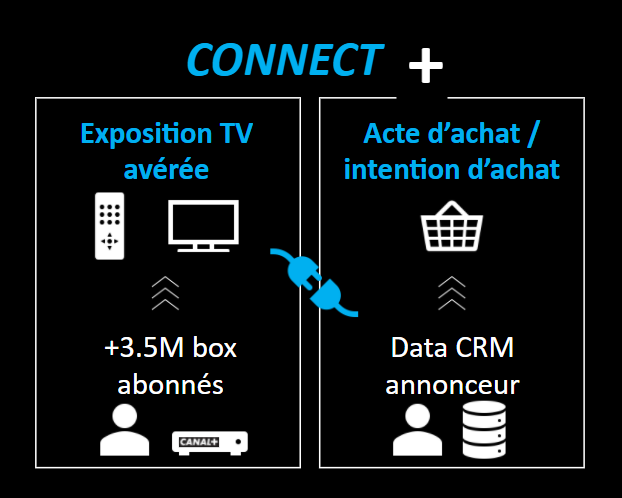

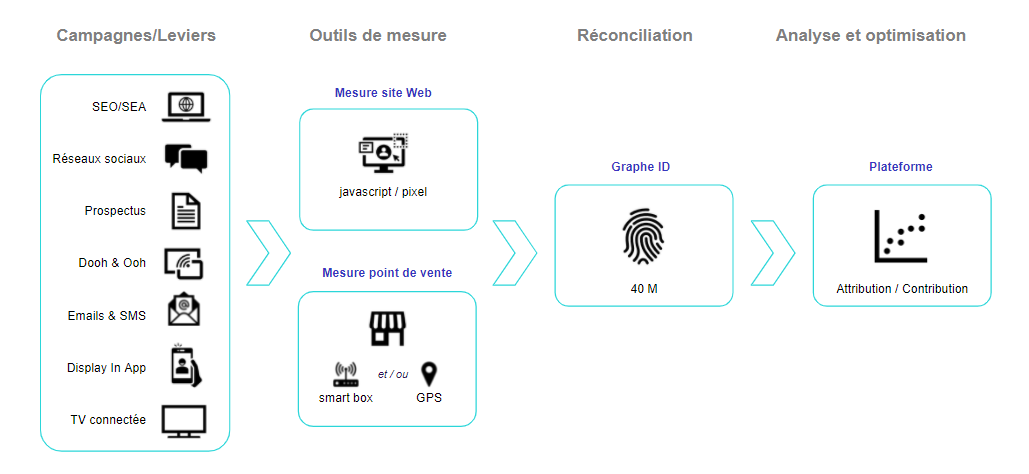

It is possible to use first party data to carry out communication tests, extrapolate performance results using statistical models (including to measure drive to store), or even measure the performance of TV advertising spots by using first-party data matching solutions such as Connect+ (from Canal+).

The challenge is also strategic: not to leave the monopoly of data to the major media platforms and distributors.

By not collecting first-party data, consumer brands will be entirely dependent on research data for consumer insights, large media platforms or distributors for targeted communication. Access to these data allowing knowledge or targeting is costly and rigid, depending on the possibilities of these platforms. It is even likely that the cost will increase further with the restrictions gradually imposed on the use of cookies.

Conversely, brands that create contact opportunities with their consumers and maintain a relational promise with them thanks to animation systems will be able to capitalize on this data over time, and optimize their marketing strategy and their activation investments.

What benefits do FMCG brands derive from first party data?

Benefit 1: develop your “audience intelligence”

Data from contact databases (customers, newsletter subscribers), but also tracking data can be analyzed through the prism of profiling solutions, in order to define personas: media consumed, centers of interest, beloved brands… This knowledge will allow guide the marketing and communication strategy, for example by choosing influencers or partnerships.