Introduction: Why is customer relationship crucial in 2024?

Customer relationships have always been at the heart of banking and insurance activities. In this sector, customers purchase intangible products, a service whose concrete reality they do not always perceive. Choosing a bank or insurance is not based on a whim. The opportunities to interact with one’s bank or insurance are not that frequent, or they are routine (checking accounts). However, even if they are not directly perceived by customers, there are indeed factors influencing their choice that marketing strategies must emphasize. Among these criteria, the quality of the customer relationship is an obvious factor: while it may be difficult for an individual to assess the service quality even after opening an account, realizing that the customer relationship is rated positively or very positively by the company’s customers is crucial.

As the sector has been disrupted in recent years by new players (notably “neo-banks”), customer experience and customer relationships have become essential issues for the future of these companies.

In this article, we will discuss the topics of personalization, customer loyalty, and digital innovation, which have become the three pillars of customer relationships in the banking and insurance sector.

1. The new challenges of customer relationships in 2024

Customer expectations continue to evolve towards more personalization, responsiveness, and omnichannel approaches. Today, when a customer contacts their bank—whether it is their assigned advisor, a customer service operator, or through a chat—they expect them to have all the necessary information to properly handle their request. And while interactions are not frequent, the speed (or even immediacy) of the response is a critical issue: it has become almost unbearable to wait or schedule an appointment to address a banking or insurance-related request.

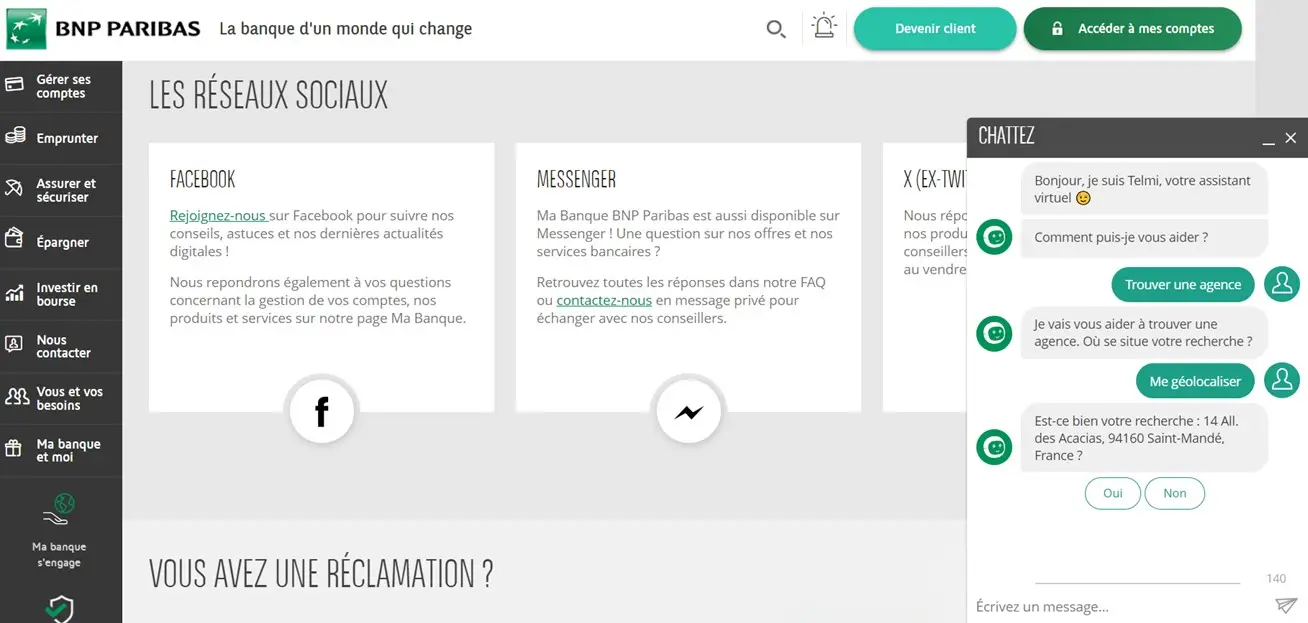

The regulatory context also changes the relationship between customers and banking institutions. The GDPR, as in all sectors, has led to increased transparency and data protection. But in the case of banks, the Payment Services Directive (PSD2) has also contributed to greater trust, especially with the enhanced security of online payments. Thanks to these evolving standards, digital channels have become essential and a key area for innovation. Mobile apps, chatbots, and artificial intelligence are reshaping the customer experience.

2. The importance of personalization in customer relationships

With the abundance of available data, banks and insurers can create useful marketing segmentations, allowing them to better personalize messages and offers. Here are a few examples.

- Bank and insurance CRMs often use age and life stages as segmentation criteria. This enables them to offer products or services tailored to the specific needs of different age groups: for young adults, fee-free current accounts or student loan offers; for families (30-50 years old), offers on mortgage loans, home insurance, or savings plans; and for seniors, retirement planning solutions, long-term care insurance, or home assistance services…

- The use of data and artificial intelligence allows banks and insurers to take personalization to another level. For instance, if a customer exceeds their overdraft limit, they could receive a notification with a personalized offer for an authorized overdraft or short-term credit. Another example based on usage: in auto insurance, personalized pricing offers can be proposed based on actual vehicle use, thanks to onboard telematics.

- Finally, modern banking and insurance apps are an excellent way to personalize the customer experience. Based on spending and savings habits, banking apps can send automatic recommendations on budget management or suggest investment opportunities. In the case of insurance, they can provide personalized monitoring: clients may receive personalized alerts to renew their insurance, optimize their coverage, or benefit from premium reductions based on their behavior (e.g., health insurance offering discounts for clients following a wellness program).

Thus, personalization in banking and insurance is a vital issue to improve the customer relationship for these companies. A study published in 2022 by marketing solutions provider Adobe showed, however, that the siloed nature of these organizations remains a barrier to creating truly omnichannel customer experiences: only 35% of executives acknowledged having “significantly reduced organizational silos” between the different marketing and customer experience teams.

3. Digitalization in the service of customer relationships

In the banking and insurance sector, the rise of digital channels is striking. While neo-banks and neo-insurers are leading this revolution, the scope of the change, which affects almost every major company in the sector, is remarkable. Self-service, mobile apps with sleek and ergonomic interfaces, genuinely effective chatbots… Digital tools have become essential for clients in managing their accounts.

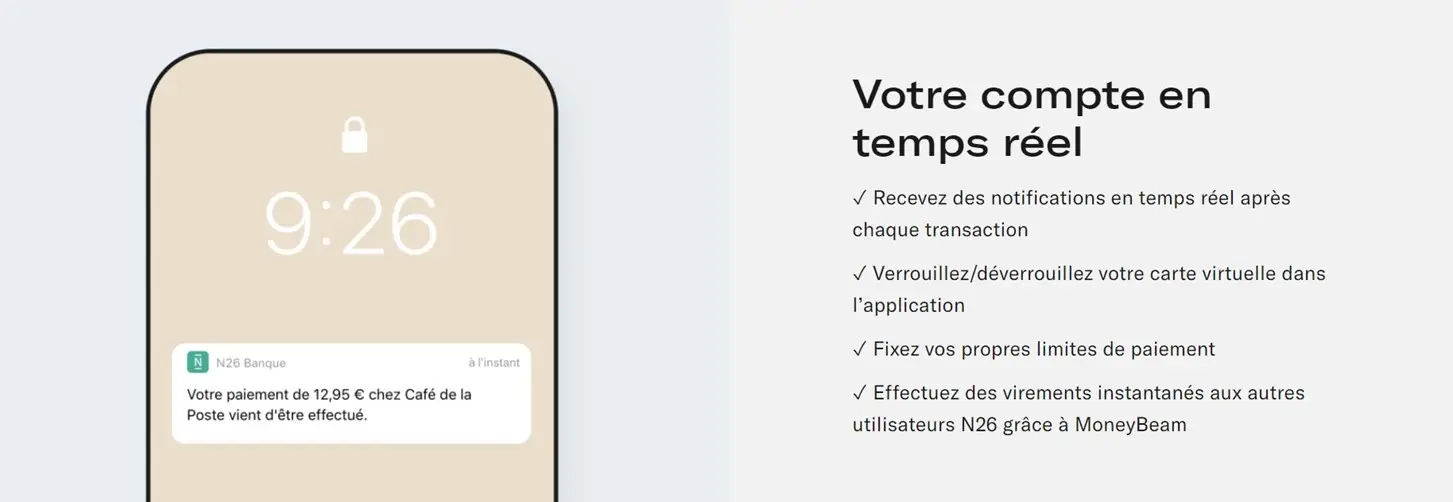

For example, N26 offers customer service in French, available 7 days a week via Livechat or email, and even reachable on social networks. The bank offers the use of virtual cards downloadable to wallets, instantly activatable and deactivatable via the mobile app. Finally, the bank stands out with its “Spaces” feature, which allows for the creation of sub-accounts in an ultra-simplified way to organize budgets and expenses according to household projects.

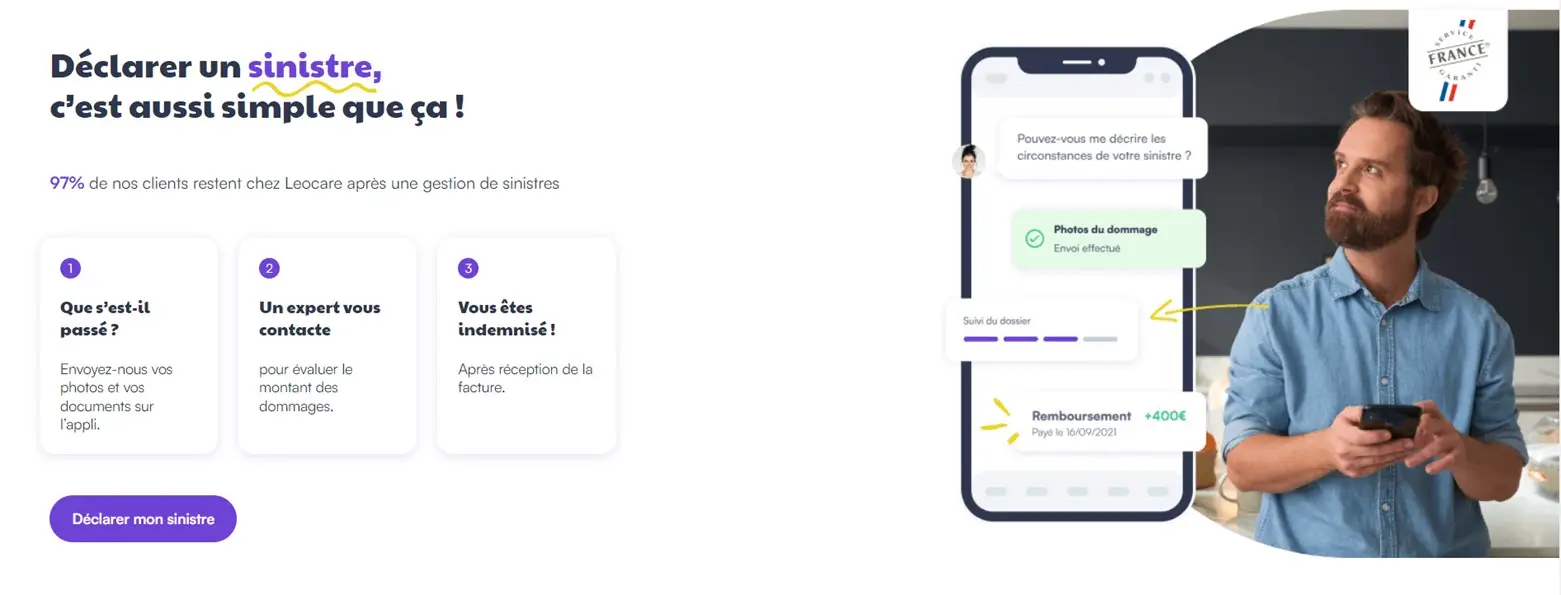

Insurance companies are not left behind in this digitalization of customer relationships. For example, the Leocare mobile app meets the challenge of making the various insurance products practical and visually appealing, giving customers control over their policy parameters via very well-designed mobile interfaces.

The insurer also highlights the simplicity of managing a claim. A claim is the eventuality one hopes will never occur but justifies the subscription: knowing that handling it is no more complicated than exchanging messages and photos via a messaging service certainly helps to reassure and retain customers.

4. Customer loyalty: A growth driver for banks and insurers

Among all the marketing levers for customer relationships, loyalty programs occupy a special place. They are both a service and a marketing tool directly aimed at increasing customer loyalty.

In 2024, the trend in the banking sector clearly favors cashback programs. Indeed, the bank card is the central element of the service, making it the cornerstone of the loyalty program: the principle is that by using the card to pay for purchases from the bank’s partner merchants or e-commerce sites, the client accumulates discounts in euros, which they can later redeem into their account. La Banque Postale and BNP Paribas offer such programs for free.

Boursorama’s “BoursoPrime” loyalty program is a paid program, but with a more comprehensive rewards system, offering generalized cashback at all merchants and benefits such as 0.5% additional interest on the Bourso+ savings account and a €10 bonus on current promotional offers.

While loyalty programs aim to create incentive mechanisms to increase the customer value of insurers and banks, displaying a high level of loyalty and satisfaction is also a great way to attract new customers. Thus, emphasizing the quality of customer service, along with price, is a classic communication strategy in the sector.

Another example in insurance: Leocare highlights its 97% post-claim customer retention rate as a selling point, prominently displayed on the home page of its website. There is no better argument for a customer-oriented strategy!

5. Proactive complaint management and customer satisfaction

In a service sector like banking and insurance, it is inevitable to face customer complaints. Limiting the number of complaints is certainly an issue, but it is just as important to plan how to respond to them effectively. Responding well to dissatisfaction is invaluable because it often allows a dissatisfied customer to become a true promoter of the brand: the company acknowledges a mistake, remedies it promptly, and even adds a small gesture, turning a problem into a positive experience and demonstrating the quality of its customer service.

The ideal is even to anticipate the complaint and proactively offer compensation. This is what La Banque Postale or Arval do, thanks to CRM systems implemented by Dékuple with the Codes For Gifts solution.

These systems help increase customer retention and significantly improve customer satisfaction scores (NPS, CSAT).

6. Upcoming trends in customer relationships for banks and insurers in 2024

CRM trends in the banking and insurance sector are built around three major axes.

- Artificial intelligence and machine learning: These technologies enable the anticipation of customer behavior and the personalization of interactions.

- The importance of ethics and transparency: Consumers are increasingly expecting transparency from financial institutions.

- The growing role of virtual assistants: The future of customer relationships in banking and insurance will partly rely on virtual assistants and AI agents.

Conclusion: How banks and insurers can stand out with enhanced customer relationships

In 2024, customer relationships remain a crucial strategic pillar for banks and insurers. The trends in personalization, digitalization, and loyalty show that customer experience is no longer just a competitive advantage, but an essential condition for sustainable growth. Personalization, enabled by the use of data and artificial intelligence, allows for customized services, while digitalization simplifies and enriches interactions with customers, thereby enhancing their satisfaction. Furthermore, loyalty programs, whether based on rewards or cashback systems, are effective levers to increase retention and attract new customers.

In this context, marketing decision-makers must seize these new opportunities to rethink their strategies, putting the customer at the heart of every interaction. Adopting an omnichannel approach, coupled with proactive complaint management, can not only improve customer satisfaction but also turn dissatisfaction into loyalty opportunities.

Finally, with the emergence of artificial intelligence and virtual assistants, it is crucial for sector players to be both innovative and ethical. By meeting the expectations of transparency and data protection, banks and insurers can stand out in a constantly evolving market and secure their long-term position. Customer relationships thus become a key differentiator and an undeniable growth driver for the years to come.